25 billion yuan, major chip mergers and acquisitions, pressure on domestic top 10

Time:2023-07-28

Views:775

On May 6, it was reported that MaxLinear and Silicon Motion announced that they had reached a final agreement that MaxLinear would acquire Silicon Motion in the form of cash and stock, and the enterprise value of the merged company would be $8 billion.

Both parties stated in the statement that Mailing Technology acquired Huirong for $114.34 per American depositary stock. This bid is 48% higher than Huirong‘s closing price on April 22nd.

Strong alliance, moving towards the top 10?

In fact, it was reported last week that Huirong, a large NAND flash memory control chip manufacturer in Taiwan, China, China, was exploring potential sales transactions. Earlier yesterday, there were rumors in the market that suitors had expressed their willingness to acquire. According to insiders, the manufacturers that have approached Huirong and are considering acquiring include MaxLinear and MediaTek.

We are quite familiar with MediaTek. Last year, with its growth in the smartphone market, revenue surged by 53.2% and net profit surged by 170% year-on-year. For MediaTek, whose financial resources have soared, the acquisition of Silicon Motion at this time will help to further enhance its influence in smart phone and other markets, as well as the proportion of chip in the whole machine.

As for MaxLinear, we are a leading supplier of RF, analog, digital, and mixed signal integrated circuits, providing services for connectivity and access, wired and wireless infrastructure, as well as industrial and multi market applications. The current products include network access, wireless Wi Fi, power management, 4G/5G infrastructure, etc. According to financial report data, MaxLinear had a revenue of $892 million and a net profit of $42 million in 2021. The current market value is less than $4.2 billion.

It is reported that this transaction is not subject to any financing conditions and is expected to be completed in the first half of 2023. After the completion of the transaction, the shareholders of Mailing Technology will hold about 86% of the shares of the merged company, and the shareholders of Silicon Motion will hold about 14% of the shares of the merged company. If the closing stock price of Mailing Technology on May 4, 2022 is taken as the criterion, the implied value of the total transaction consideration of Silicon Motion is US $3.8 billion.

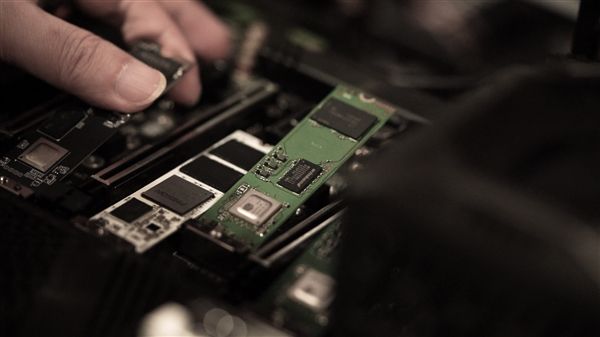

It is not difficult to find that Silicon Motion has customers all over the world, including all NAND Flash factories, module factories of storage devices, large data centers and other OEM factories. Its storage control chips support various NAND Flash flash produced by Intel, Kioxia, Micron, Samsung, SK Hynix, Western Digital and YMTC.

Looking at the global control chip market, Samsung and Western Data‘s main manufacturers account for about 45% of the market share; Silicon Motion, Qunlian Electronics, Marvell and other manufacturers together account for more than 40% of the market share.

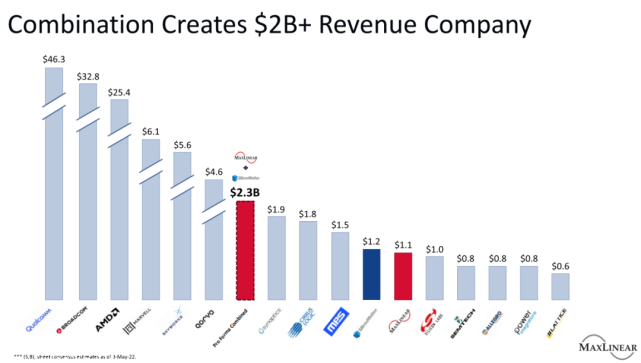

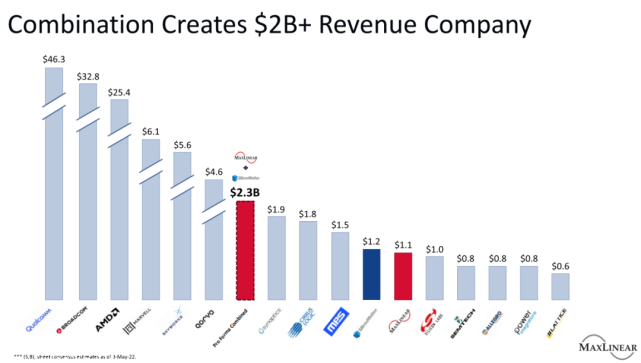

According to the estimates of the two companies, this acquisition will bring about a change in the overall pattern of the chip design industry: the annual consolidated revenue is expected to exceed $2 billion, and with mutual support in technology, the overall potential market opportunity targeted can reach $15 billion.

Based on the global Top10 chip design threshold calculated by third-party institutions, the total revenue of the merged company will boost the new company‘s ranking in the Top10. In other words, it is roughly estimated that the merger of the two companies is expected to enter the global chip design Top10 camp.

Source: Mailing Technology official website

However, Huirong has been dominating the storage industry for many years, establishing sufficient prestige and market influence, and suddenly announcing its sale is still quite surprising. Why is it?

Highlighting business bottlenecks, huddling together for warmth?

According to the latest financial report of Silicon Motion, in 2021, the annual revenue will reach 922.1 million dollars, the annual growth rate will reach 71%, and the net profit after tax will reach 219.33 million dollars. Yesterday (5), Silicon Motion just announced its financial results for the first quarter of 2022 as of March 31. The financial report shows that the company‘s revenue for the first quarter was $242 million, exceeding the company‘s high-end guidance.

It is not difficult to find that since the third fiscal quarter of 2020, Silicon Motion‘s quarterly revenue and non GAAP net profit have been rising steadily, and the Gross profit rate has also been stable at about 50%.

In fact, as the leading storage master manufacturer in the industry, Silicon Motion is ambitious. It had planned that Silicon Motion would become the world‘s largest client SSD controller chip manufacturer in 2021, with annual shipments of more than 160 million, a global market share of about 38%, and an eMMC/UFS master chip market share of about 30%.

Of course, in addition to the optimization of Silicon Motion‘s own product structure, the price rise caused by the shortage of master chip supply is the reason for the rise of Silicon Motion‘s performance.

Although the performance is rising quarter by quarter, Silicon Motion is also accompanied by internal and external worries, and the company‘s future development is full of uncertainty.

After all, in the context of "weak" terminal shipments, whether it‘s SSDs or embedded storage devices, although each storage device‘s capacity can continue to grow, it can only carry one main control chip. In addition, the price of the main control chip is difficult to increase significantly, and the development bottleneck of the main control market has gradually emerged.

In fact, in the performance composition of Silicon Motion, it can be mainly divided into two parts: master chip and storage module solutions. The performance income of Silicon Motion is heavily dependent on the main business, but the high R&D cost superimposed on the limited market increment, the development of the main industry has become a bottleneck, and the future growth pressure can be imagined.

In general, Silicon Motion is still in a good stage in the current "lack of core" environment and the dominant market, so it is a good choice to choose to sell.

On the other hand, the radio frequency, analog/mixed signal and processing capabilities of Mailing Technology, combined with the NAND Flash control chip technology of Silicon Motion, will complete a comprehensive technology stack, fully grasp the comprehensive functions of the end-to-end platform, and accelerate the growth of enterprise level, consumer and other Relevant market.

Moreover, although on the whole, there is still a gap between manufacturers in Chinese Mainland and large overseas manufacturers in terms of company size and globalization. However, compared to industry leaders, the domestic storage control chip industry is generally characterized by technological differences and differences in enterprise size.

For example, currently, domestic SSD main control chip manufacturers including Deyi Microelectronics, Guoke Micro, Lianyun Technology, Hualan Micro, Yingren, Yixin, Derui, Jiangsu Huacun, etc. are continuously expanding their influence.

Therefore, the rise of semiconductor power in Chinese Mainland in recent years has undoubtedly brought pressure to the industry, and overseas manufacturers have to consider mergers and acquisitions and other ways to continue to maintain overall advantages in future competition.

Supported by the high demand for semiconductors in the global market over the past year, both companies have achieved historic highs in performance, and working together is bound to be another case of strong alliance.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |