Development layout and investment map of American industrial control giant Honeywell

Time:2023-07-24

Views:789

Source: Core Octopus Author: Don

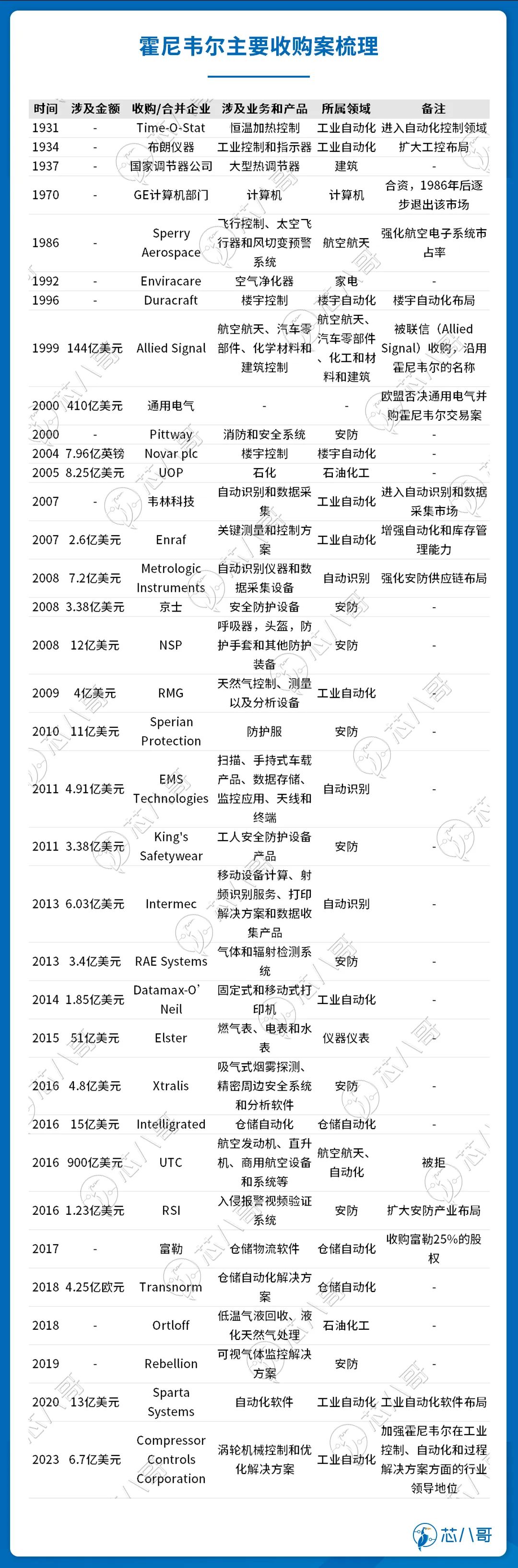

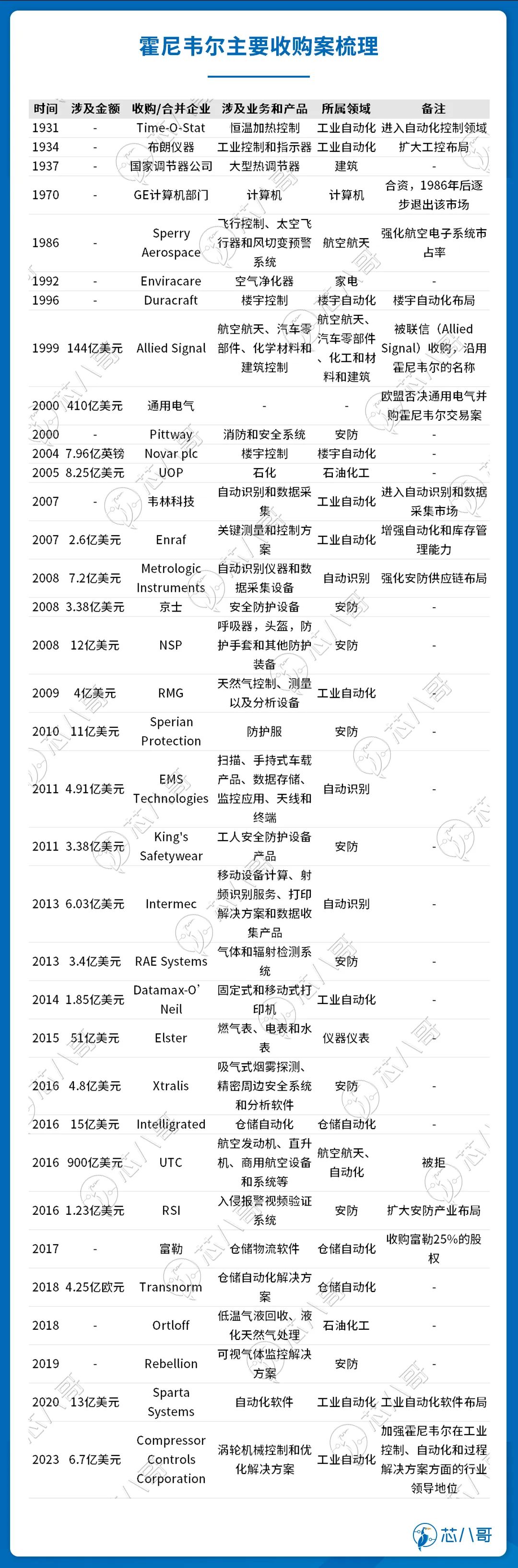

It can be said that Honeywell‘s development history is a merger and acquisition history spanning a century.

Strong integration, moving from water heaters to high-tech

Honeywell‘s predecessor, Butz Thermoelectric Regulator Company, was established in 1885, with its initial product being a thermostat. The company was renamed twice in 1893 and 1916, and merged with Honeywell Heating in 1927. The Honeywell brand, which has been in use since then, expanded its main business from thermostats to become the largest jewelry and watch manufacturer at that time.

In the following decades, Honeywell Company entered multiple segmented fields such as industrial automation, computer, security, aerospace, petrochemical, automotive, and new materials through a large number of mergers and acquisitions. Its commercial territory continued to expand and it has become one of the well-known industrial control giants we are now familiar with.

Source: Honeywell official website, organized by Octopus Core

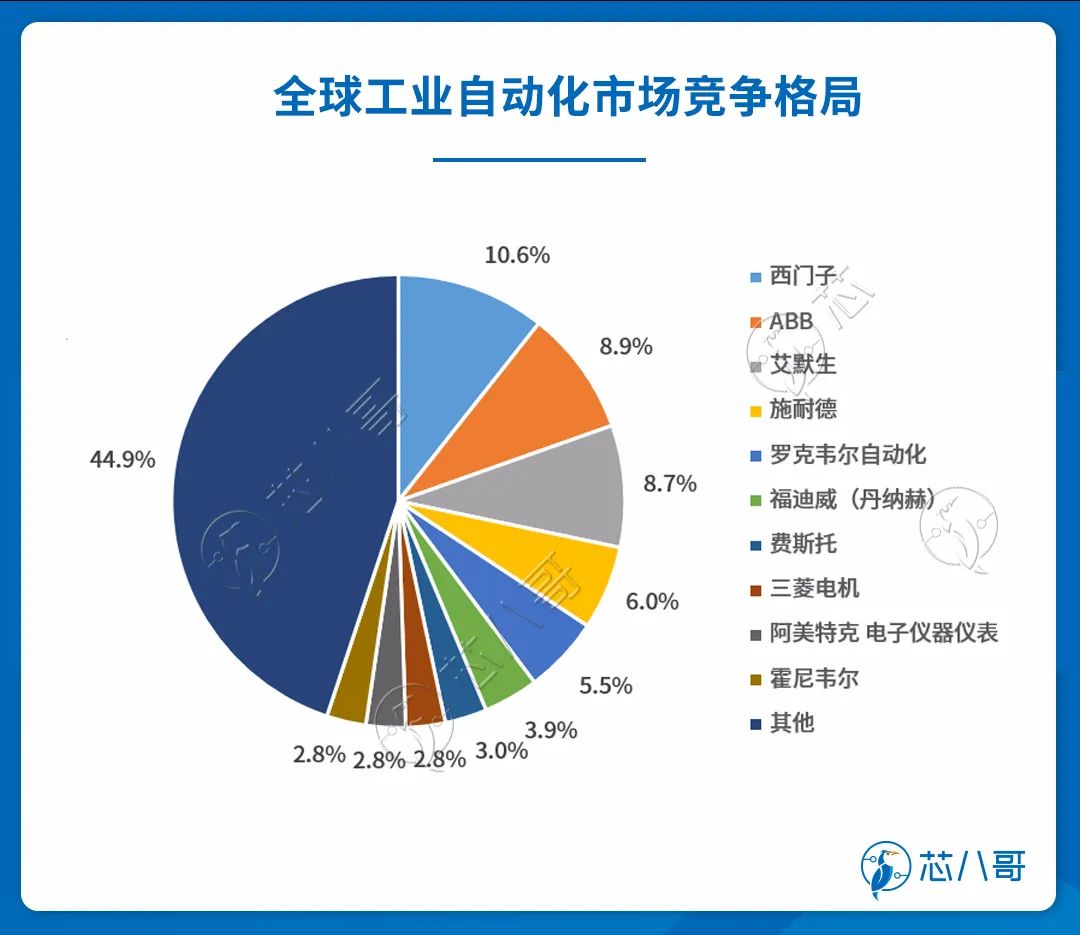

Taking industrial automation as an example, after acquiring Brown Instruments in 1934 to accelerate the layout of its industrial automation business, it has gradually grown into a leading global supplier of integrated system integration solutions for process industries. According to the 2021 Top 50 World Automation Companies released by Control Global in the United States, Honeywell ranks tenth with $3.742 billion, with a market share of approximately 2.8%.

Source: Control Global

It can be said that Honeywell is one of the typical representative enterprises that have grown and strengthened through multiple mergers and acquisitions. Since its first acquisition in 1898, the company has accumulated over a hundred mergers and acquisitions, becoming increasingly large like a greedy snake. Its product line has been continuously strengthened, continuously expanding its business scope and market share.

Investment territory: large-scale acquisition, expanding territory

Strong integration has always been the main theme of Honeywell‘s development, and mergers and acquisitions are an important means of product evolution and expansion.

From the perspective of merger and acquisition amount, according to incomplete statistics of Core Octopus, the budget for Honeywell‘s merger and acquisition amount from 2010 to 2014 (five-year budget) is about 5 billion US dollars; In the first five years of 2018, its budget for acquisition transactions reached $10 billion; Although the budget amount of M&A has not been announced since 2018, it can be seen from the planned acquisition of aviation engine giant UTC (United Technologies Corporation, United Technologies, parent company of Pratt&Whitney) for $90 billion in 2016 that its internal M&A amount has been increasing.

From the perspective of the number of mergers and acquisitions, according to the incomplete sorting of Core Octopus, Honeywell has completed over 100 acquisitions in the past 15 years, with a total revenue increase of over 13 billion US dollars. At present, it is still continuing to search for suitable acquisition targets, and the focus of its mergers and acquisitions is to extend its layout around the industrial automation industry chain. For example, the acquisition of Elster, a leading British manufacturer of Hydronics and instrumentation, with US $5.1 billion in 2015 was the largest acquisition in the past decade; In 2016, Intelligrated, a leading supplier of supply chain and warehousing automation, was acquired for $1.5 billion. In 2020, Sparta Systems, a leading supplier of enterprise quality management software (QMS), was acquired for $1.3 billion. All above have further strengthened Honeywell‘s leadership in industrial automation, Digital transformation solutions and Business performance management software.

Source: Compiled by Core Octopus

Looking back at Honeywell‘s century long development, two major mergers have shaped the current Honeywell. In 1927, the first major merger tasted the taste of leading in the field of segmentation, and in 1999, it was acquired by Lianxin to establish the company‘s position as a diversified giant; Except for the mergers and acquisitions of General Electric in 2000 and UTC in 2016, which were both resolved due to monopolistic reasons, "buy buy buy" helped the company become a superpower spanning multiple fields such as industrial automation, aerospace, construction, petrochemical, high-performance materials, healthcare, and security.

To sum up, expansion through mergers and acquisitions is a gene integrated into Honeywell‘s bones, and its forward-looking Sex industry layout is also commendable.

Industrial layout: China as the main player, supplemented by India

Honeywell has always adhered to a coordinated development strategy of talent, technology, capital, and cooperation in its global business layout, especially in the Chinese market. Based on local market demand, Honeywell provides corresponding technical support and adjusts its direction and strategy in a timely manner at different times and stages.

From the perspective of regional layout, except for the United States, China has become one of Honeywell‘s largest production bases and sales markets. Specifically, in terms of production bases, China has become one of Honeywell‘s major global research and development centers and innovative manufacturing bases. Taking industrial automation as an example, Honeywell Tianjin Factory is the company‘s largest production base of industrial automation products in the world, and Chorzów Factory and Suzhou Factory in Poland are its key factories in the field of warehousing automation. In addition, in recent years, the company has actively expanded its business layout in India, with seven manufacturing factories in India.

In terms of core agents, China is mainly concentrated in North China represented by Beijing, East China represented by Shanghai, Suzhou, Hangzhou and Xuzhou, and South China represented by Shenzhen. The distribution of core agents is the same as that of Honeywell‘s major sales regions in China.

According to incomplete statistics and summary in Honeywell‘s annual report, relying on the integrated system integration solution for the process industry, potential orders of interest in emerging markets in the next few years will exceed 100 million US dollars. At the same time, the company is continuing to seek excellent acquisition targets in the fields of aerospace, building control, process automation, and warehousing automation to strengthen itself, with huge development potential.

In summary, it can be found that Honeywell‘s success was not achieved overnight, but rather through a typical approach of "epitaxial mergers and acquisitions+endogenous growth" to create a powerful and diverse product matrix.

Specifically, it is through mergers and acquisitions that we improve our business system, adhere to sustained and significant R&D investment, and combine it with a sharp industrial layout to gradually widen the gap with other manufacturers, ultimately achieving the goal of being strong.

For domestic manufacturers, with the increasingly complex international trade environment and policy situation, external mergers and acquisitions are no longer sustainable. However, they can try to participate in domestic collaboration and investment, while also focusing on the integration of production and research and talent reserves, gradually achieving domestic substitution through point-to-point breakthroughs.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |