Spot price and prediction of the latest MCU

Time:2022-12-15

Views:1408

Introduction: The latest statistical forecast of the third party group intelligence consulting shows that from the second half of 2022, the shortage of automotive MCU is more obvious than that of other chips. In the third quarter, the market price of automotive MCU has increased by about 5-10%. After 2023, the shortage of automotive MCU will gradually ease.

On November 15, it was reported that the latest report of the third-party organization Sigmantell pointed out that in 2022, the global car sales in the first three quarters would be about 58.2 million, a year-on-year decline of 3.3%. It is estimated that the annual sales would be about 80.8 million, basically the same as last year.

The report predicts that the automobile sales in Chinese Mainland will reach 27 million in 2022, exceeding the pre epidemic level. Data shows that from January to October, the production and sales of new energy vehicles in China reached 5.485 million and 5.28 million respectively, with a year-on-year growth of 1.1 times and a market share of 24%.

In terms of vehicle MCU, Qunzi Consulting said that the market price of vehicle MCU will increase by 5-10% in the third quarter of 2022. After 2023, the shortage of vehicle MCU will gradually ease, and the supply and demand of the whole year will return to a more benign state. However, as new energy vehicles are in a period of rapid growth, the absolute demand for vehicle MCU is still in a stage of substantial increase, and the price of MCU is still difficult to decline in the short term. It is expected that the price will fall back by 2024.

In the long run, due to the accelerated process of automobile intelligence, automatic driving has gradually moved from L2 to L3 or even L4, and the utilization rate of its body controller will gradually decrease, so the demand for middle and low-end MCU products will also decrease, and the demand for 32-bit MCU to achieve high-end control functions and integrated SOC chips will increase significantly.

The domestic vehicle specification grade MCU started late, and it welcomed the good opportunity of domestic replacement under the background of "lack of core". Data shows that, at present, manufacturers including Zhaoyi Innovation, Fudan Micro, Xinhai Technology, Zhongying Electronics and so on are all producing standard MCU products and have successively passed AEC-Q100 certification. In addition, major domestic chip manufacturers have unveiled their own vehicle grade MCU product lines. In addition to national technology, smart microelectronics, Canxin Semiconductor and other typical representatives of domestic MCU, there are also Xiaohua Semiconductor, which has just been separated from Huada Semiconductor. There are players such as Hang Shun, Jihai, Xinwang Micro, who have been in the limelight in recent years, and also new players such as surging microelectronics and leading microelectronics MCU established in recent years.

In general, Qunzi Consulting predicts that the global sales of new energy vehicles will reach 28.8 million by 2027. Compared with 2021, the average carrying capacity of functional chips such as MCU and storage will also double.

It is worth mentioning that, in response to the recent rumors of recruitment freeze and layoff, GLOBALFOUNDRIES, the global semiconductor wafer foundry, said to the Economic Observer Network today (November 15) that it is starting the recruitment freeze and taking a series of targeted actions to selectively reduce the number of our employees.

It is reported that Grofand just released strong financial data for the third quarter and provided solid guidance for the fourth quarter. However, based on the current macroeconomic environment, the company is taking a very self-discipline and proactive approach to cost control, just like the industry and the entire technology industry.

The wafers produced by Grofand are oriented to many types of terminals, including RF chips for mobile phones, chips for 5G communication base stations, MCU chips for automobiles, etc. The company said that in terms of RF front-end modules, it is adjusting the inventory of mobile phones. The automotive terminal market has always been one of the brightest spots in the market. The company is introducing new MCU and security applications to the market.

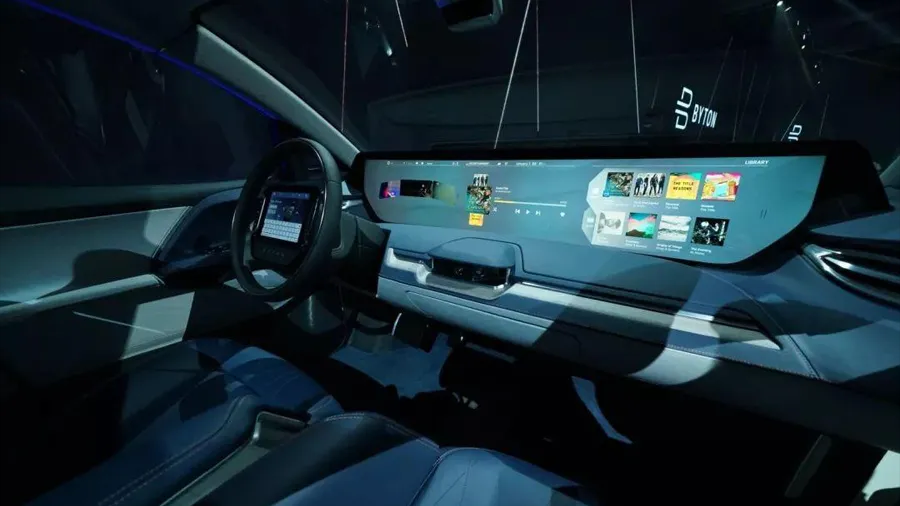

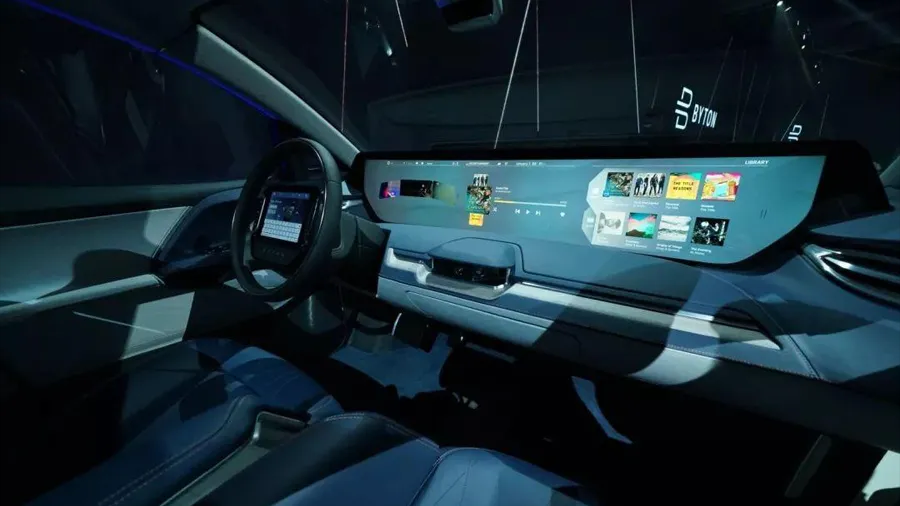

As we all know, the function of vehicle MCU is mainly to control all known electronic systems in the vehicle, such as multimedia, audio, navigation, suspension, etc. As the core of the automotive electronic control system, the automotive MCU must have better heat resistance and reliability than the consumer electronic products, so that it can continue to operate in the complex internal environment of the vehicle without being easily damaged.

According to the statistics of Jibang Consulting, Grofand ranked fourth in the revenue ranking of the top ten global wafer foundry enterprises in Q2 2022, and the top three were TSMC, Samsung and UTC in turn. 90% of the company‘s revenue comes from wafer foundry. Because of the huge investment in advanced process research and development, the company announced to abandon the 7nm advanced process in 2018 and fully invest in the manufacturing of mature process chips.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |