Latest prediction! Semiconductor demand may rebound at this point

Time:2022-11-30

Views:1456

Introduction: The latest report of the American Semiconductor Industry Association (SIA) mentioned that the market cycle is expected to rebound in the second half of 2023; Sigmantell predicts that the inventory adjustment cycle of the overall chip market will last at least until the second half of 2023; In addition, it is reported that semiconductor fabs have begun to agree with customers to delay the shipment. Under various current conditions, IC Insights is worried that the semiconductor industry‘s capital expenditure will show the largest decline since 2008 next year.

On November 28, it was reported in the latest report of the American Semiconductor Industry Association (SIA) that 2022 is a historic year for the semiconductor industry. The industry continues to face major challenges. The industry is known for its cyclical cycle. It is expected that the market cycle will not rebound until the second half of 2023.

It is reported that SIA said that the shortage of chips has reminded people of the importance of semiconductors. 2022 will be a very successful and important year for the industry, because semiconductors have a greater impact on the world than in the past.

However, SIA said that the shortage of chips will gradually ease in 2022, the growth of global semiconductor sales will slow down significantly in the second half of this year, and the industrial growth rate will decline.

Source: Network

Today, the latest news from Taiwan, China Economic Daily shows that the demand for wafers has weakened due to the de stocking of logic IC and the massive reduction of production by memory chip factories. Some wafer factories have agreed to delay shipment to a few customers, delaying the schedule by about 1-2 months; In addition, wafer fabs negotiate with customers, and may slightly delay the shipment from the first quarter of next year. In addition, some manufacturers are willing to cooperate with the market situation to negotiate prices with customers, and do not hesitate to say that "it may be a little harder in the first half of next year". Some manufacturers frankly said that the semiconductor market is really bad now, and the wafer terminal cannot survive. The inventory level of long-term clients has been increasing, and it may have reached the limit. At this stage, the wafer shipment status is not consistent with the actual market demand.

Coincidentally, as the downstream market demand has not significantly warmed up for the time being, the inventory level in the IC design industry has risen. Sigmantell predicts that the inventory adjustment cycle of the overall chip market will last at least until the second half of 2023. As downstream orders decrease, the wafer foundry industry will also face inventory pressure. In 2022, the inventory level of most wafer fabs will increase, and the upward trend will be more obvious from the second quarter. In addition, Qunzi Consulting predicted that the capacity utilization rate of most wafer fabs would further decline in the fourth quarter.

Therefore, from the perspective of wafer foundry, the comparison with the situation mentioned in the latest report of the American Semiconductor Industry Association (SIA) is basically mutually supportive.

Source: Network

Not long ago, taking automotive semiconductors as an example, Morgan Stanley pointed out that some automotive semiconductors, such as MCU and CIS suppliers, including Rexa Semiconductor and Ansome Semiconductor, are currently cutting some chip test orders in the fourth quarter, indicating that automotive chips are no longer out of stock.

However, the Taiwan, China Electronic Times pointed out that Hidetoshi Shibata, CEO of semiconductor manufacturer Rexa Electronics, said that although there were some signs of easing the shortage of automobile chips, analog chips were still in a tight supply state.

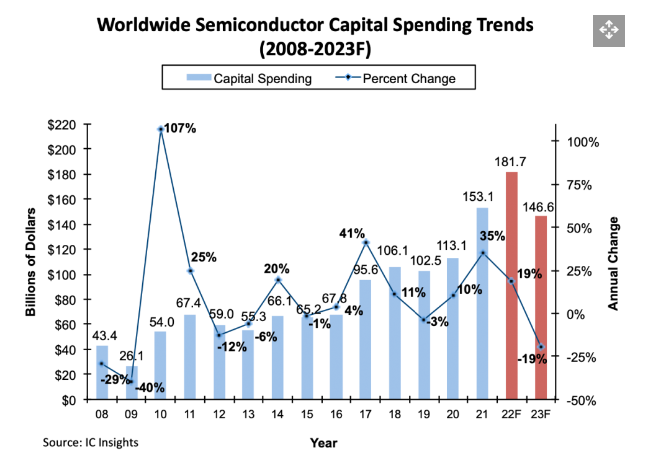

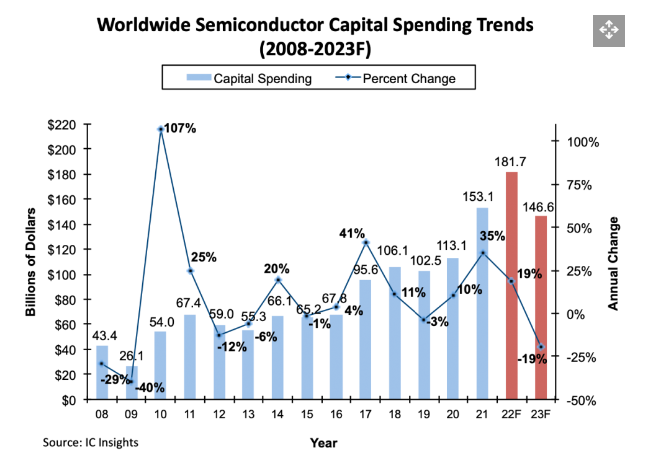

From the perspective of semiconductor industry capital expenditure. According to the previous forecast of IC Insights, the capital expenditure in 2022 will increase by 19% year on year, reaching US $181.7 billion, a new high.

However, in view of the constant changes in the above objective conditions, Intel and Micron are now reviewing their capital expenditure plans for 2023. IC Insights has revised its forecast and believes that the industry‘s expenditure will decline by 19% to 146.6 billion dollars in 2023. IC Insights pointed out that the 19% year-on-year drop in capital expenditure was the largest drop since the global financial crisis in 2008-2009.

Global semiconductor capital expenditure and forecast

Source: IC Insights

In addition, IC Insights believes that the storage industry will be more affected than the logic industry because the major manufacturers will reduce capital expenditure by 25%.

However, almost all chip manufacturers (including logic and memory chips) expect their product demand to rebound from 2024 to 2025. Therefore, they believe that they need to expand production capacity to meet the demand in this decade. Therefore, in 2024-2025, the capital expenditure of new plants will increase significantly.

It is reported that wafer factories under construction or equipped in the United States, including those of Intel, Micron, Samsung, TSMC and Texas Instruments, will go online on time because of the high cost of postponing these projects.

IC Insights believes that, as part of the CHIPS and Science Act of the United States, the funding for American semiconductor suppliers will not significantly promote their spending in 2023, because they will replace their own investment in new factories with the funding they will receive soon.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you! |